Business

Adani Power Soars 8% on June 10 – Here’s Why the Rally Matters

Adani Power Stock Jumps 8%: Powering Ahead in June

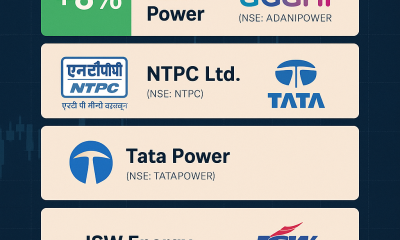

On Tuesday, June 10, Adani Power Ltd witnessed a sharp 8% surge in its share price, making it one of the top gainers in the Indian equity market. The power stock rode the wave of broader sector momentum, with the BSE Power Index rising nearly 10%, as market sentiment turned bullish post-election clarity and energy reform optimism.

🔍 Key Reasons Behind the Rally

✅ 1. Strong Power Sector Momentum

Power sector stocks outperformed across the board, riding on higher power demand expectations, fresh government push for infrastructure, and favorable reforms.

✅ 2. Political Stability Boosts Investor Confidence

The recent general election results provided political continuity. With expectations of faster policy implementation, especially in infrastructure and energy, investors are re-rating power stocks positively.

✅ 3. Institutional Buying & Technical Breakout

Large-scale institutional buying was evident in the day’s volume, and technically, Adani Power broke out from a recent consolidation phase, hitting new resistance levels.

✅ 4. Renewable Energy Play

Adani Group’s continued focus on green energy, solar and hybrid projects, and plans for massive thermal expansion align with India’s energy transition roadmap.

📊 Overall Market Snapshot

-

Sensex: Closed at 81,363.60 (flat)

-

Top Gainers: Power, Realty stocks

-

Top Losers: FMCG, Banking

📈 Technical Outlook: Is ₹1,000 Next?

According to analysts, if momentum continues, ₹1,000 could be a near-term target. Immediate support is at ₹860, with resistance near ₹950.

“A sustained breakout can see Adani Power testing all-time highs soon,” says a MarketsMojo analyst.

🛒 Related Stock Market Essentials

📌 Related Articles